By Sagar Shah and Ruchi Bhat

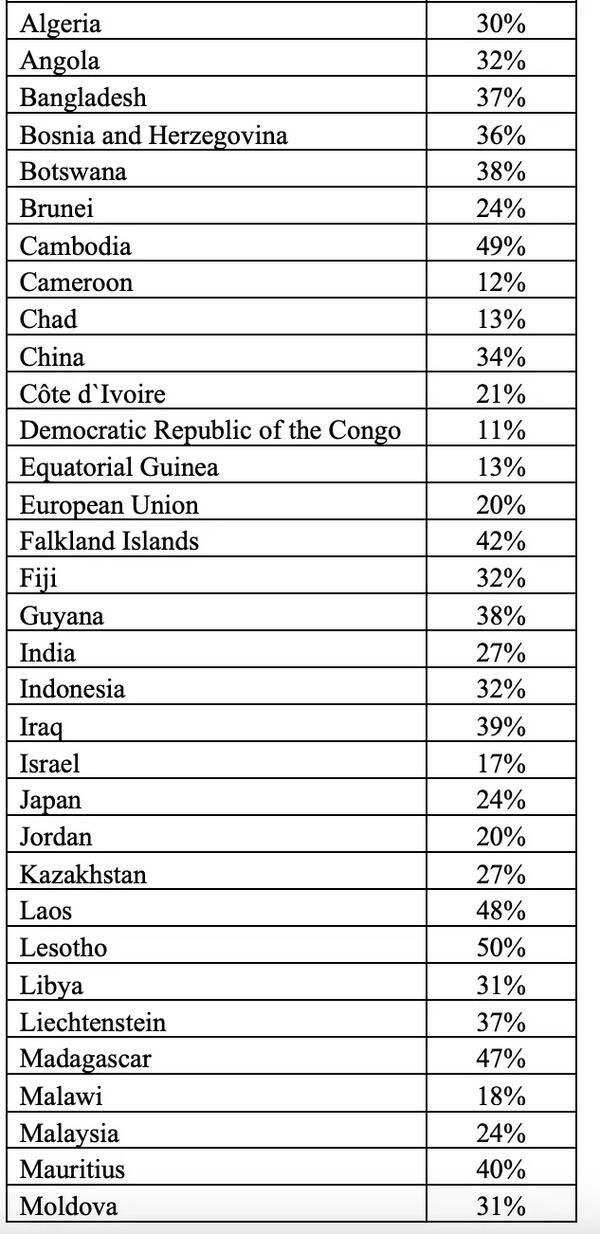

The ‘liberation’ journey that started in Mr. Donald Trump’s first stint with China trade war continued as major campaign focus for second one. So the World anticipated reciprocal tariff changes in Trump 2.0 version. 2nd April 2025 was announced as ‘Liberation Day’ by imposing extensive reciprocal tariff for identified prescribed countries and ad valorem additional 10% duties for rest imports from rest of the countries. The average tariff rates imposed by respective countries were considered and then reciprocal tariffs are planned to be introduced at a discounted rate as follows vide Executive Order issued by the President of US on 2 April 2025 (EO) –

Tariffs

Tariffs

Levy introduction, coverage and exemption

As per section 3 of EO, the implementation plan of the new rate levy has been prescribed as follows –

Additional Ad-valorem duty of 10% for all imports (irrespective of country of origin) into the US from 5 April 2025

Ad-valorem above mentioned country specific duties for all imports from respective countries into the US from 9 April 2025

Exemption from new tariff rates

Following set of products have been exempted from this EO either for granting exemption or because they have been covered under other tariff hike orders (as prescribed in Annexure II) –

While the US has issued EO to impose country wise incremental tariffs, they have also reserved right to increase/ reduce the tariff rates if respective countries retaliate with tariff hike or take necessary steps to remedy non-reciprocal trade arrangements.

Also Read | TOI Explainer: How India may gain from Trump’s tariffs

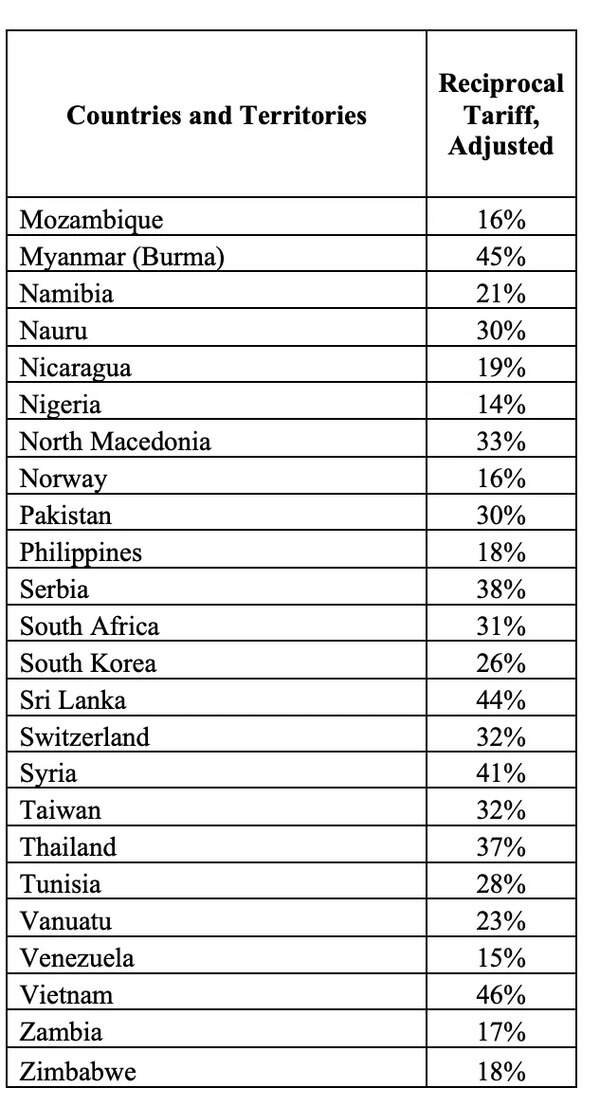

While US accounts for 18% of India’s total goods exports, it would be relevant to understand real impact of reciprocating tariff being imposed on India. Top 10 sectors of supplies from India to US (FY 23 in USD) with duty rates are as follows –

Top 10 sectors of supplies from India to US

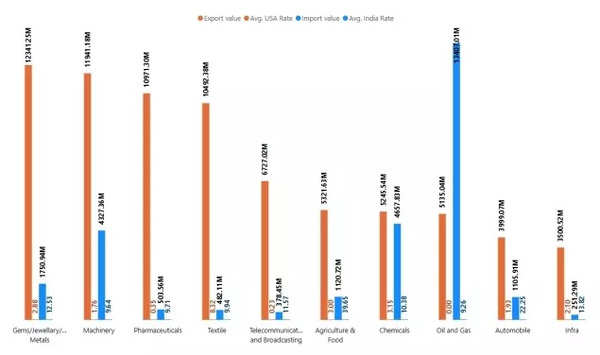

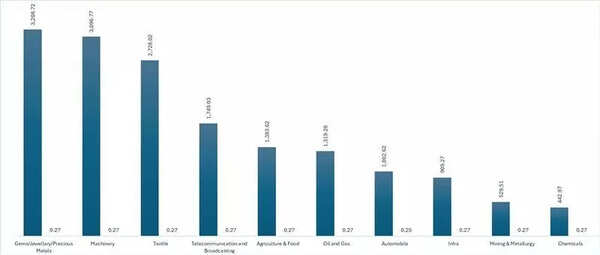

Now, with increased duty rates the incremental duty impact basis FY 23 exports to US would be as follows –

Incremental duty impact

Demand elasticity of Indian products in US market would determine the cushion Indian industry has in spite of tariff reciprocation. The sectors like pharma, textile, telecommunication may fall in this bracket. The very reason why products like generic medicines and oil & gas items have been kept out of the reciprocal tariffs is the fact that the demand elasticity of these products is very high. However, sectors like agriculture, food, chemical may get larger hit of reciprocative tariffs, since US market may resort to other lower duty countries.

It would be interesting to see this in other sectors like Auto and textiles as well. Many auto part manufacturers moved production facilities to China and Mexico earlier and then to South East Asia amidst the first wave of tariffs in US in 2018. It would be difficult for companies to invest and ramp up production in USA again at least in the short to medium term. Another impact is the ESG approach to production and supply chain management which has left production of limited high margin and specific products being manufactured by the domestic industry in US. It is estimated that imports satisfy more than 45% of the domestic demand and basis a report by Kelly Blue Book it is estimated that average price of cars would go up anywhere between USD 3000 to 10,000 either considering increased tariffs or buying locally in US.

Also Read | Donald Trump announces 26% ‘discounted’ reciprocal tariff on India: What will be the impact and is Indian economy relatively insulated?

When it comes to the textile industry, it would be interesting to see that basis the increase in tariff to imports ratio, Indian exporters may still be in a better position as compared to two of its largest competitors:

While US has over a period reduced dependency on China by moving towards other countries, it still needs to be seen as to how it would be able to develop and sustain domestic manufacturing. Accordingly, this protectionist strategy may initially lead to increased cost due to high import duties until the US domestic manufacturing becomes independent. In line with this principle, India has been working on spreading global markets and ‘Make in India’ initiatives to become self-sufficient. This would help Indian exporters to sustain in these changing global tariff scenarios.

As a response to such reciprocity India may consider granting export linked incentives to Indian exporters or corresponding retaliative tariff hike for some of the select sectors with lesser dependency on US suppliers. The most viable option for India at this stage would be to conclude India-US trade agreement discussions and reach a consensus which would help both countries to align for respective economic growth.

(Sagar Shah and Ruchi Bhat are Tax Partners at EY India)