India will keep purchasing oil from Russia despite U.S. President Donald Trump’s threats of penalties, two Government sources told The New York Times, not wishing to be identified due to the sensitivity of the matter.

“These are long-term oil contracts,” one of the sources said. “It is not so simple to just stop buying overnight.”

Mr. Trump last month indicated in a Truth Social post that India would face additional penalties for purchases of Russian arms and oil. On Friday (August 1, 2025), Mr. Trump told reporters that he had heard that India would no longer be buying oil from Russia.

Soured relations: The Hindu editorial on Trump’s 25% tariff, ‘penalty’

The New York Times on Saturday (August 2, 2025) quoted two unnamed senior Indian officials as saying there had been no change in Indian government policy, with one official saying the government had “not given any direction to oil companies” to cut back imports from Russia.

Reuters reported this week that Indian state refiners stopped buying Russian oil in the past week, following a narrowing of discounts in July.

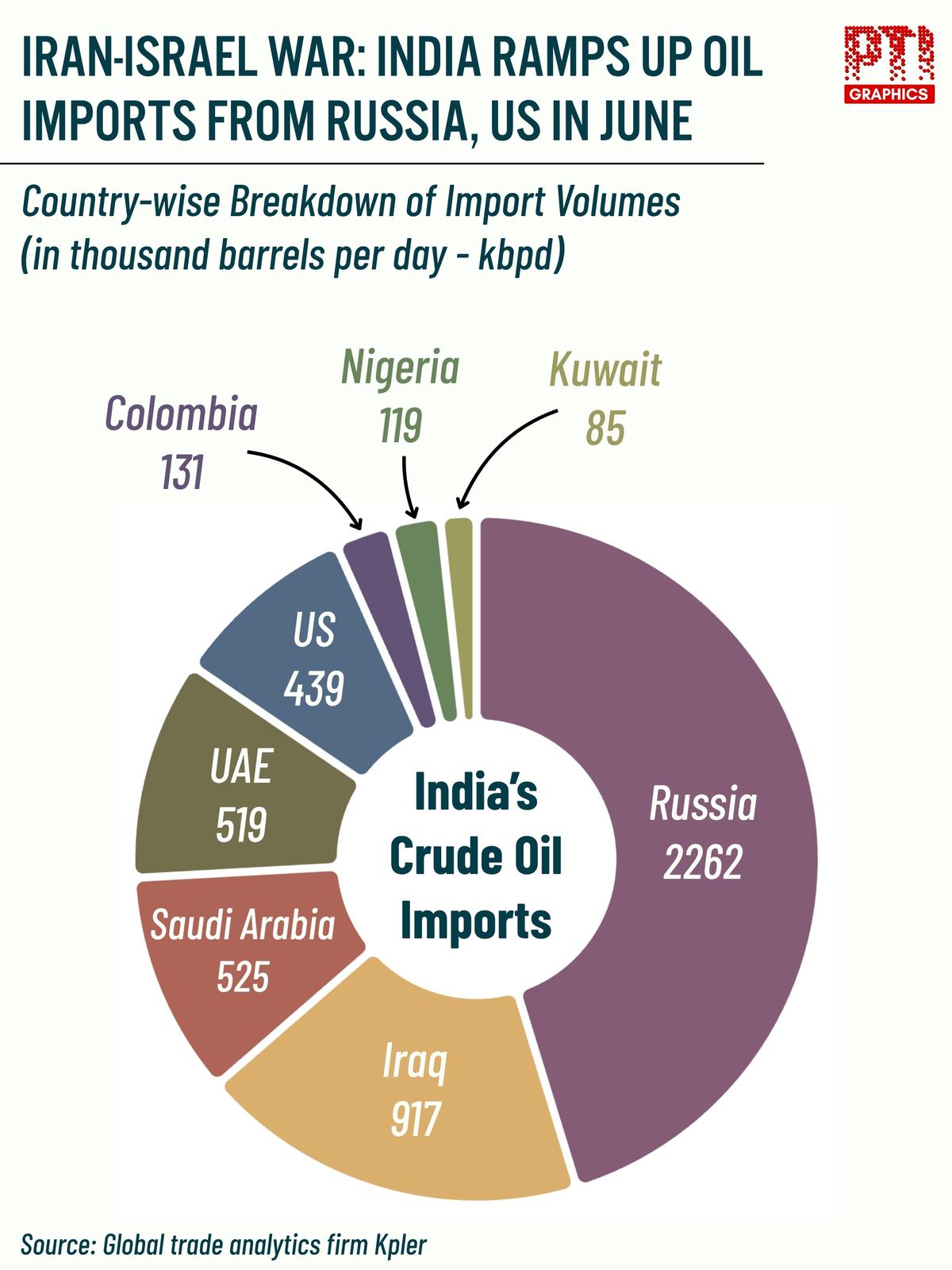

Country-wise Breakdown of Import Volumes

| Photo Credit:

PTI GRAPHICS

“On our energy sourcing requirements … we look at what is there available in the markets, what is there on offer, and also what is the prevailing global situation or circumstances,” Foreign Ministry spokesperson Randhir Jaiswal told reporters during a regular briefing on Friday.

Mr. Jaiswal added that India has a “steady and time-tested partnership” with Russia, and that New Delhi’s relations with various countries stand on their own merit and should not be seen from the prism of a third country.

The White House in Washington did not immediately respond to requests for comment.

Indian refiners are pulling back from Russian crude as discounts shrink to their lowest since 2022, when Western sanctions were first imposed on Moscow, due to lower Russian exports and steady demand, sources said earlier this week.

The country’s state refiners — Indian Oil Corp, Hindustan Petroleum Corp, Bharat Petroleum Corp and Mangalore Refinery Petrochemical Ltd — have not sought Russian crude in the past week or so, four sources familiar with the refiners’ purchase plans told Reuters.

India’s top oil supplier

On July 14, Mr. Trump threatened 100% tariffs on countries that buy Russian oil unless Moscow reaches a major peace deal with Ukraine. Russia is the top supplier to India, responsible for about 35% of India’s overall supplies.

Russia continued to be the top oil supplier to India during the first six months of 2025, accounting for about 35% of India’s overall supplies, followed by Iraq, Saudi Arabia and the United Arab Emirates.

India, the world’s third-largest oil importer and consumer, received about 1.75 million barrels per day of Russian oil in January-June this year, up 1% from a year ago, according to data provided to Reuters by sources.

Nayara Energy, a major buyer of Russian oil, was recently sanctioned by the European Union as the refinery is majority-owned by Russian entities, including oil major Rosneft .

Last month, Reuters reported that Nayara’s chief executive had resigned after the imposition of EU sanctions and company veteran Sergey Denisov had been appointed as CEO.

Three vessels laden with oil products from Nayara Energy have yet to discharge their cargoes, hindered by the new EU sanctions on the Russia-backed refiner, Reuters reported late last month.