US President Donald Trump has unveiled extensive reciprocal tariff proposals, declaring “our country has been looted, pillaged, raped, plundered” by foreign nations. During his speech on ‘Liberation Day’, Trump displayed a chart illustrating proposed reciprocal tariffs: 34 per cent on Chinese goods, 26 per cent on Indian goods, 20 per cent on European Union imports, 25% on South Korean products, 24 per cent on Japanese items and 32 per cent on Taiwanese merchandise.

‘Pathetic European Union…’: Trump Tears Into ‘Foes-Like Friends’; Announces Reciprocal Measures

“My fellow Americans, this is Liberation Day, waiting for a long time. April 2nd, 2025, will forever be remembered as the day American industry was reborn, the day America’s destiny was reclaimed, and the day that we began to Make America Wealthy Again…Taxpayers have been ripped off for more than 50 years,” Trump declared during his White House address. “But it is not going to happen anymore.”

Poll

How do you perceive the impact of the 26% tariff on Indian goods in the US?

As per the board held up by Trump, the tariffs charged by India to the US are 52% and the ‘discounted’ reciprocal tariffs by US will be 26%.

US President Donald Trump announces reciprocal tariffs (AP Photo)

Also Check | Donald Trump tariff announcements live

What Donald Trump announced:

According to Trump, the US imposes a modest 2.4 per cent tariff on imported motorcycles, whilst other nations implement substantially higher rates. “The United States charges other countries only a 2.4 per cent tariff on motorcycles. Meanwhile, Thailand and others are charging much higher rates, like 60 per cent. India charges 70 per cent, Vietnam charges 75 per cent, and others charge even higher rates,” he said.

“Likewise, until today, the United States has, for decades, charged a 2.5 per cent tariff. Think of that 2.5 per cent on foreign-made automobiles. The European Union charges us more than 10 per cent tariffs, and they have a 20 per cent VAT much, much higher. India charges 70 per cent and perhaps worst of all are the non-monetary restrictions imposed by South Korea, Japan, and many other nations as a result of these colossal trade barriers.”

“India, very, very tough. Very, very tough. The Prime Minister just left. He’s a great friend of mine, but I said, ‘You’re a friend of mine, but you’re not treating us right. They charge us 52%. You have to understand, we charge them almost nothing for years and years and decades, and it was only seven years ago, when I came in, that we started with China,” Trump added.

Also read: India’s first reaction on Donald Trump’s 26% reciprocal tariffs: ‘It’s mixed bag, not setback…’

Trump’s reciprocal tariffs

This is the full list of reciprocal tariffs that Trump announced:

1. China: 34%

2. European Union: 20%

3. South Korea: 25%

4. India: 26%

5. Vietnam: 46%

6. Taiwan: 32%

7. Japan: 24%

8. Thailand: 36%

9. Switzerland: 31%

10. Indonesia: 32%

11. Malaysia: 24%

12. Cambodia: 49%

13. United Kingdom: 10%

14. South Africa: 30%

15. Brazil: 10%

16. Bangladesh: 37%

17. Singapore: 10%

18. Israel: 17%

19. Philippines: 17%

20. Chile: 10%

21. Australia: 10%

22. Pakistan: 29%

23. Turkey: 10%

24. Sri Lanka: 44%

25. Colombia: 10%

The risks for India

It’s important to note that the exact impact of Trump’s reciprocal tariffs on various sectors in India will be easier to analyse as more details emerge.

- India has the potential to sustain or increase its agricultural shipments to the US, notwithstanding the fresh tariffs declared by President Donald Trump. This assessment comes from noted agricultural economist Ashok Gulati, who suggests that India holds an advantage as rival countries encounter higher duty rates. The Trump administration’s implementation of a 26 per cent “discounted reciprocal tariff” on Indian products would have a restricted effect on crucial agricultural exports, particularly seafood and rice, in comparison to the steeper duties levied on regional rivals, Gulati said.

- The Indian Pharmaceutical Alliance has expressed satisfaction on Thursday regarding the US decision to keep pharmaceuticals off its tariff list. Secretary General Sudarshan Jain highlighted the strengthening India-US commercial relationship through Mission 500, which seeks to achieve $500 billion in two-way trade.

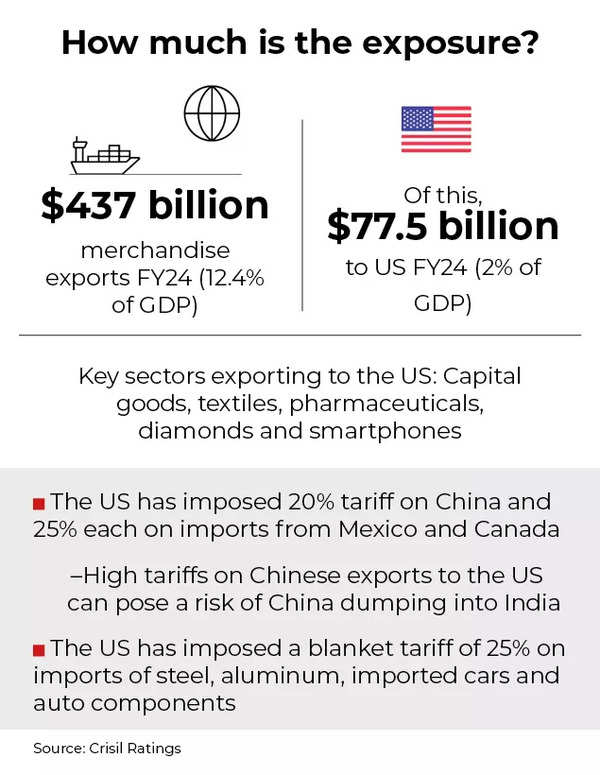

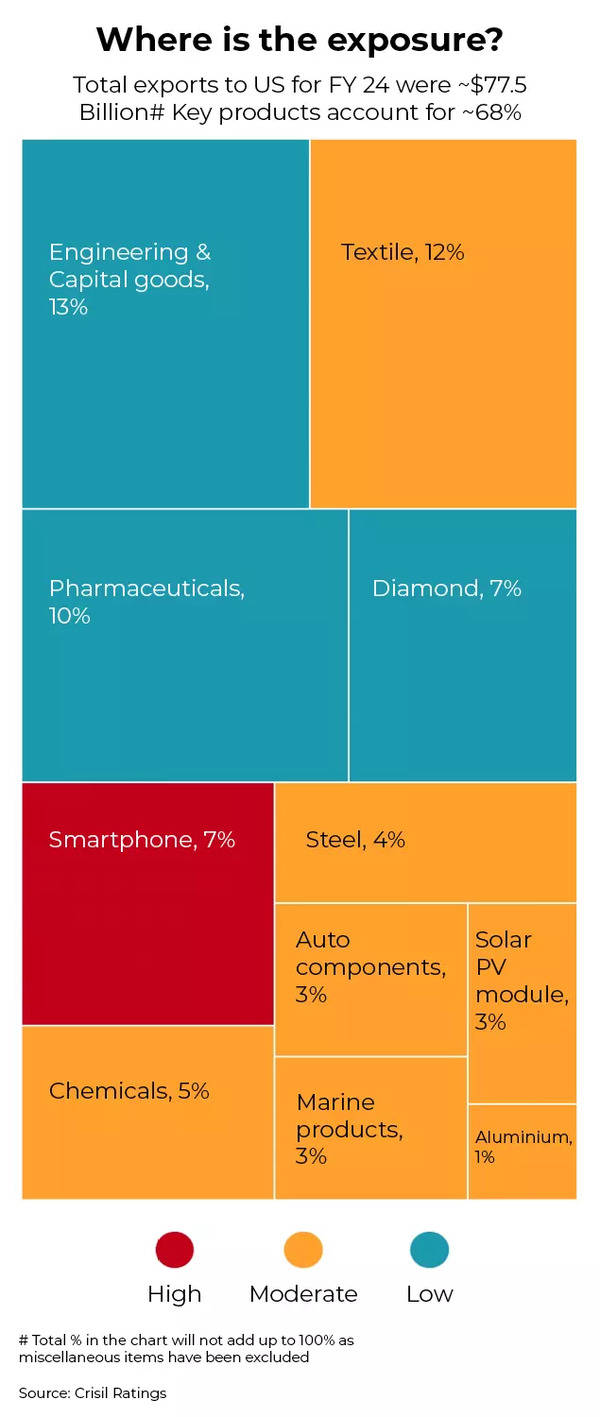

- Saurabh Agarwal, Tax partner at EY India said, “India’s pharmaceutical sector enjoys protection from reciprocal tariffs, keeping it insulated from tariff increase. Additionally, Indian goods face significantly lower tariffs in the US compared to those from China and Vietnam (additional difference arising on account of reciprocal tariffs released being 7% and 19% less, respectively), creating the possibility of growth potential for India’s telecommunication and textile manufacturing sectors.” “While 18% of India’s total exports are destined for the US, anticipated supply chain shifts are expected to open new export opportunities. Although short-term export fluctuations may occur, the mid-to-long term outlook suggests possible export growth for India (contingent on final international trade negotiations with the US). To fully leverage this potential, the Indian government should expand existing Production Linked Incentive (PLI) schemes in these sectors to cover a wider range of products and extend their duration by two years, thereby bolstering domestic industries’ investment and global competitiveness,” he said.

- Tariff rates will vary based on product categories and their countries of origin, according to GTRI founder Ajay Srivastava. The policy outlines that certain essential and strategic products will be exempt from tariffs, including pharmaceuticals, semiconductors, copper and energy commodities such as oil, gas, coal and LNG. For remaining merchandise, a dual-tier tariff structure will be introduced. Beginning April 5, 2025, all imports will initially be subject to a 10 percent baseline tariff.

- The policy implements a 25 percent tariff on crucial industrial products, encompassing aluminium, steel, automobiles, and automotive components, applicable to the majority of nations.

- The taxation will apply only to the non-U.S. component of items containing 20 percent or more U.S.-manufactured content. Additionally, small-value consignments below USD 800, primarily comprising e-commerce purchases, will continue to be charged at previous tariff levels.

- Ahead of Trump’s reciprocal tariffs announcement, a few days ago a Citi Research report warned that the move could mean possible annual losses up to $7 billion.

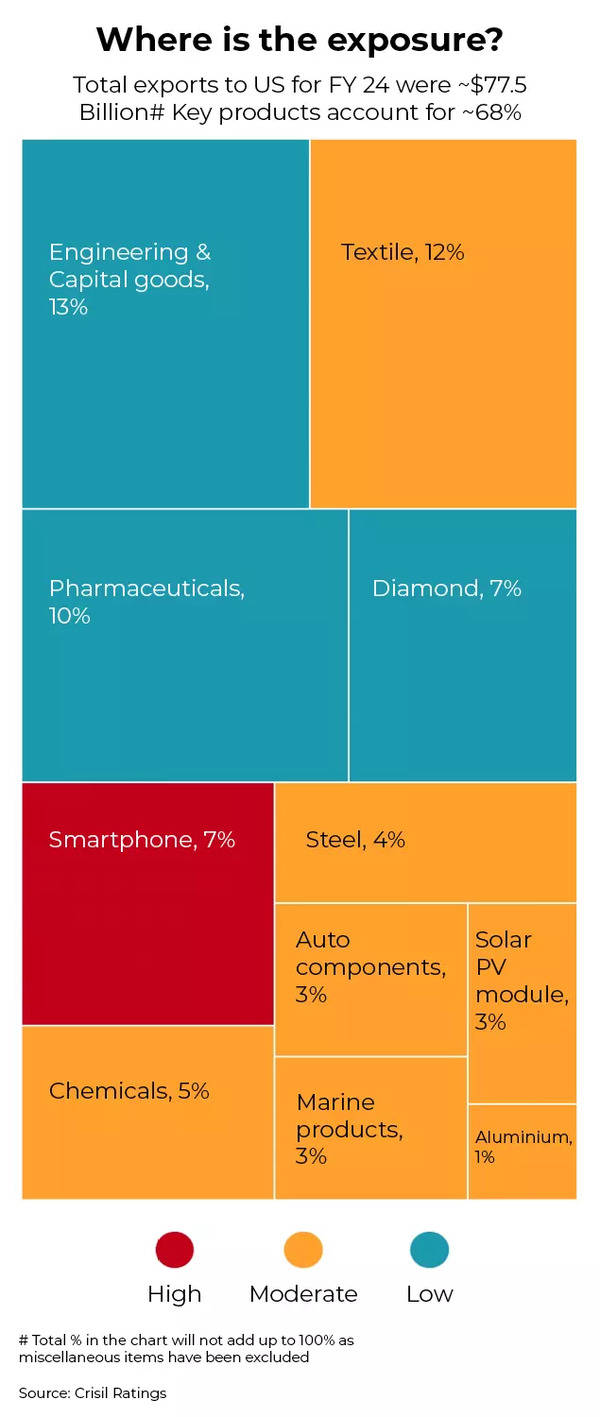

- Citi analysts have identified chemicals, metal products and jewellery as sectors facing the highest vulnerability, whilst automobiles, pharmaceuticals and food products remain substantially exposed.

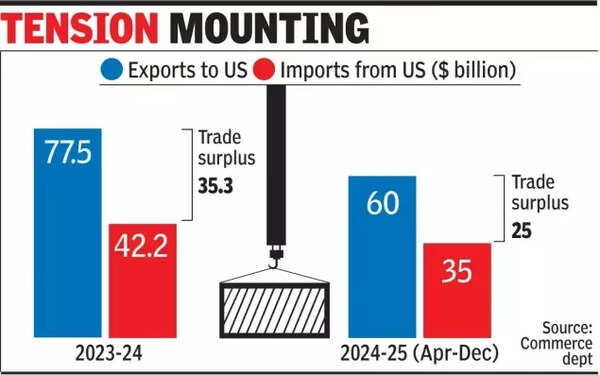

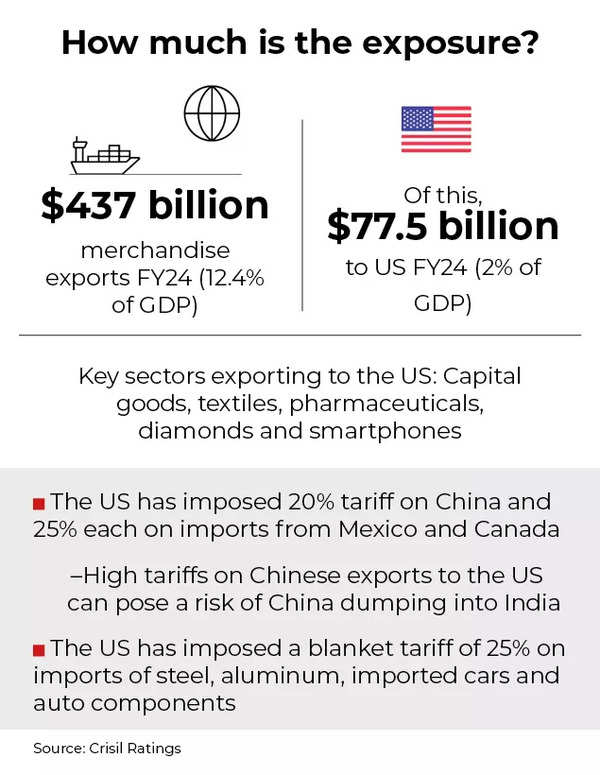

- India’s merchandise exports to the United States totalled around $74 billion in 2024, with pearls, gems and jewellery accounting for $8.5 billion, pharmaceuticals contributing $8 billion, and petrochemicals amounting to approximately $4 billion.

- Although a trade deal between India and the US could be reached by autumn 2025, the negotiations are expected to be intricate and lengthy, owing to various trade-related complexities between the two nations, Morgan Stanley has said.

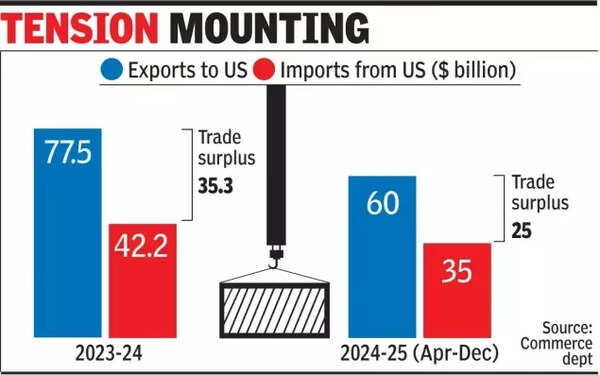

India US Trade

How much is the exposure?

Where is the exposure?

…but is India relatively insulated?

A recent SBI Research report said that the impact of Trump’s tariffs is likely to be limited. This sentiment is echoed by several global research and ratings firms and banks such as Goldman Sachs, Nomura, Morgan Stanley and Fitch.

According to the SBI analysis, the potential impact of US tariff reciprocity on Indian exports would be modest. It projected a reduction of approximately 3 to 3.5 per cent, with an assumption of tariffs ranging between 15 and 20 per cent.

The report indicates that India’s strategic approach to export diversification, emphasis on value addition, exploration of alternative markets, and development of new trade routes from Europe to USA through the Middle-East would offset the effects of US tariffs.

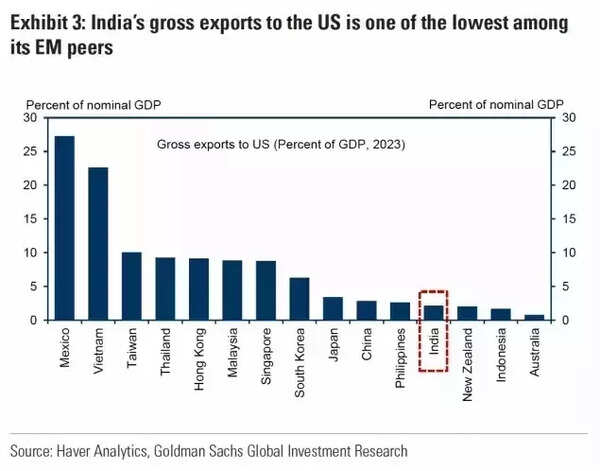

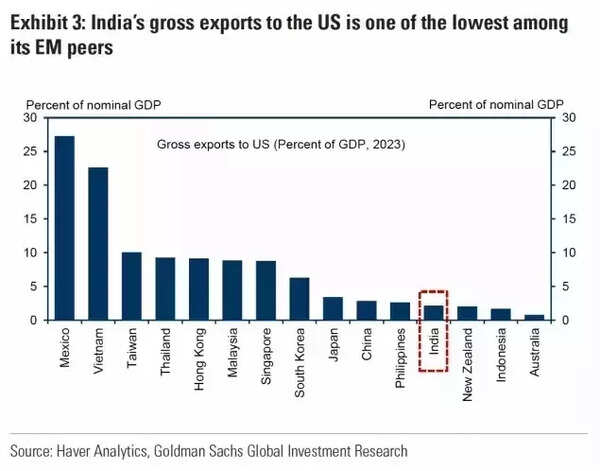

Goldman Sachs notes that India’s gross exports to the US is one of the lowest among its Emerging Market peers. Fitch says India’s low reliance on external demand makes it ‘somewhat insulated’.

India’s gross exports to US amongst the lowest…

Based on Nomura’s recent findings, India stands as one of Asia’s most resilient economies in the ongoing trade conflict.

The country’s exposure remains limited, with exports to the US constituting only 2.2% of its GDP, whilst Vietnam shows significantly higher exposure at 25.1%.

Nomura’s study on Asian contribution to US-bound global exports identifies Vietnam as having the highest risk exposure (8.9% of GDP), with other nations following: Taiwan (6.3%), Thailand (5.6%), Malaysia (4.6%), Singapore (4.5%) and South Korea (4.5%). The electronics and computing sector faces substantial risks from tariff-induced supply chain disruptions.

Across industries, Asian economies show highest susceptibility to automotive tariffs, followed by semiconductors and steel sectors as the next most exposed areas.

Morgan Stanley says, “While India is exposed to direct tariff risks, we have consistently highlighted that the bigger effect on growth from tariffs likely comes via the indirect transmission channel of weaker corporate confidence from heightened policy uncertainty and the spillovers to capex and trade cycle. From this perspective, India’s low goods trade orientation and ability to generate domestic demand offset mean it is among the least exposed economies within the region from an indirect effect standpoint.”

Despite the looming impact from Trump’s tariff moves, global economists believe India will continue to be the fastest growing economy in the world. According to the IMF’s January World Economic Outlook, India will become the world’s third largest economy in the coming years.

Advantage India?

A Financial Times report citing Aston University’s econometric research says that severe global retaliation against Trump’s proposed 25% tariffs could result in a $1.4 trillion reduction in global income and significantly impact international trade.

Initial analysis suggests India could potentially benefit alongside the UK, Japan, and South Korea. These nations might experience increased export opportunities in areas where US buyers seek alternatives to suppliers affected by tariff barriers. The trade diversion could particularly favour India.

India’s prospects appear promising in electronics, pharmaceuticals, and textiles sectors, which align with the “Make in India” programme. The country’s emerging status as a manufacturing alternative to China, combined with its independence from major trade groups like the EU, could make it an attractive supplier during uncertain times.

However, these advantages are limited and temporary. As noted by a senior economist at a New Delhi-based think tank: “India might benefit from a few supply chain shifts, but if the global trade environment turns volatile, capital flows will become unstable, inflation will rise, and the ripple effects will catch up.”

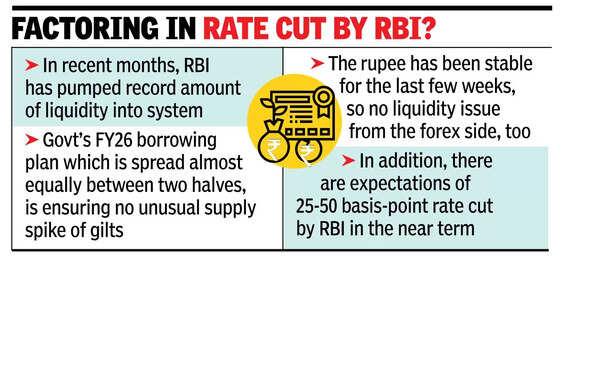

Additionally, India’s reliance on imported energy, machinery, and sophisticated components poses risks. A widespread trade conflict would increase import costs, potentially leading to higher inflation and reduced government fiscal flexibility. The Reserve Bank of India, already concerned about food prices, might need to implement stricter monetary policies, potentially affecting economic growth.

Ultimately, whilst India might experience initial advantages, it remains vulnerable to the broader negative consequences of global trade disruption.

How is India preparing for US tariffs?

- India is developing a comprehensive strategy to strengthen economic ties with the United States. India is evaluating several scenarios to understand the potential impact of reciprocal tariffs announced by US President Donald Trump on April 2, according to officials.

- The governments of India and the United States have established a timeline to finalise the initial phase of their agreement by September-October 2025. Additionally, both nations have set an ambitious objective to escalate their two-way trade from the current $190 billion to $500 billion by 2030, which is a substantial increase of more than twofold.

- The commerce and industry ministry has developed various models considering tariff differences and duties that Trump has implemented across different nations and industries to safeguard American manufacturing.

- Officials from the ministry have engaged with local manufacturers to understand the non-tariff obstacles their products encounter in the US market.

- Additionally, the ministry is collecting input from Indian businesses regarding non-tariff restrictions encountered during US exports. A dedicated online platform for documenting such export barriers is scheduled to launch within the next two months.

- The Nomura report indicates that India is prepared to negotiate a broad trade and investment agreement, offering reduced tariffs on specific products including pork, premium medical devices and luxury motorcycles, whilst providing production-linked incentives for shipping and support for logistics firms.

- India also plans to increase its procurement of US products across multiple sectors, encompassing defence equipment, aircraft, oil and gas, technology and medical diagnostic equipment.

- To establish itself as a credible alternative to Chinese manufacturing, India is offering enhanced incentives, including tax benefits and simplified land access in states such as Andhra Pradesh, Gujarat and Tamil Nadu. These benefits target sectors like semiconductors, electronics, aircraft components and renewable energy.

- India aims to integrate into US supply chains by extending concessions to US firms that establish production facilities in India for fundamental and intermediate products, including basic semiconductors, solar panels, machinery and pharmaceutical items, the Nomura report said.